Actual cash value is the depreciated value of an item of property at the time of the loss. This type of settlement does not allow you to replace what you've lost. Rather, it compensates you for the value of the item as if it was being sold at a garage sale. If money is changing hands—such as when real estate is being sold—deeds will usually list a nominal amount of consideration (e.g., $10.00) or list the actual purchase price of the property. And some states, including Alabama and Michigan, require that the consideration be clearly stated. The actual percentage of your taxable income you owe the IRS is called an effective tax rate. To calculate your effective tax rate, take the total amount of tax you paid and divide that number by your taxable income. Your effective tax rate will be much lower than the rate from your tax bracket, which claims against only your top-end earnings. The actual loan amount is $5000 even, but the monthly payment is rounded to the nearest penny causes FV to return a slightly different result. Related formulas. Calculate compound interest. The FV function can calculate compound interest and return the future value of an investment. To configure the function, we need to.

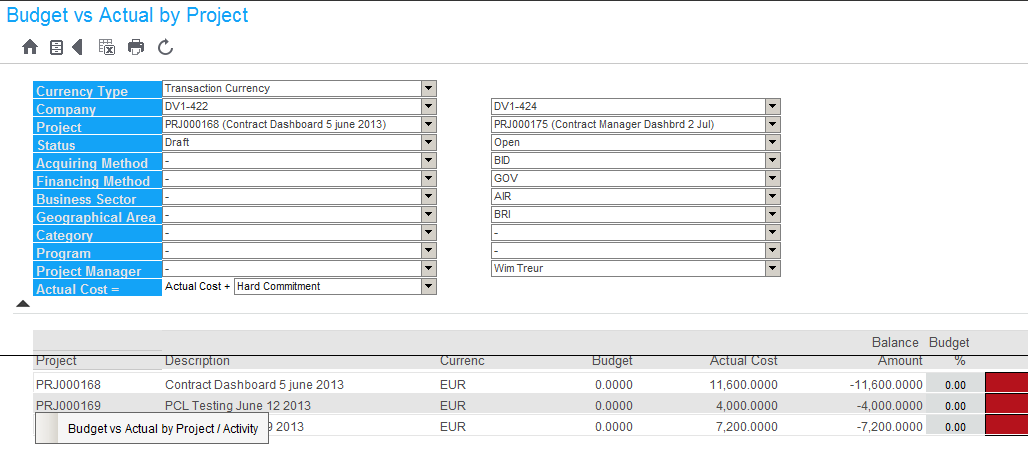

The Actual Expense vs. Budget Expense chart compares your actual expenses to your budgeted expenses for the current fiscal year to date. The chart includes two bars per month. The first bar indicates your actual expenses while the second bar indicates your budgeted expenses. When you hover over a bar, a pop-up displays with the month and the exact amount details for the month. You can drill down on a month on the bar chart by clicking on the bars to get into the GL code records and documents. The vertical label (Y-axis) displays the actual amounts and the horizontal label (X-axis) displays months.

This page displays three grids: Details, Codes, and Actual Expense vs. Budget Expense.

Details

Selected Month: Displays the selected month for which the expense details are displayed.

Budget Version: Displays the primary budget version.

Fiscal Year Beginning Date: The first day of the fiscal year for which you are entering transactions. This date cannot be changed after the organization is created.

Transaction Date From: Specifies the start date of the month for the transaction.

Transaction Date Through: The system displays the actual transactions through the current date (the date you login into the system) when you are viewing the current month, otherwise, it specifies the end of the month date for the selected period.

Codes

To search for a GL Expense account type, enter the GL code or title into the search box at the upper left of the table. All the transactions that match begin showing up in the list. To display the record, click on the blue link in the 'Expense' column for that GL Code.

GL Account Code: The system displays the ID associated with Expense types.

GL Account Title: The title assigned to the GL code.

Expense The actual expense incurred for the line item. Click the Expense to display the Actual Expense vs. Budget Expense | GL Code chart.

Budget: The budgeted or estimated expense for the line item.

Difference: The amount difference is calculated by subtracting the actual expense from the budget expense.

%: The percentage difference is calculated by subtracting the actual expense from the budget expense, and dividing the difference by the budgeted amount for that GL Code.

Actual Expense vs. Budget Expense

The system displays a snapshot of the actual vs. budget expenses for the selected month:

Budget Total: The budgeted or estimated total for the specified month of the primary budget version.

Expense Total: The actual expense incurred for the specified month of the primary budget version.

Variance: The amount difference is calculated by subtracting the actual Expense Total from the Budget Total expense.

Percent Variance: The percentage difference is calculated by subtracting the actual Expense Total from the Budget Total and dividing the difference by the budgeted total for the month selected.

Here is an example of how MIP calculates the percent variance on the back-end:

It subtracts the budgeted amount from the actual amount to find the increase or decrease from the budgeted amount and divides the difference by the budgeted expense. If you budgeted $1,000 for broker fees and you spent $1,500, subtract $1,000 from $1,500 to find you went over budget by $500 and divide $500 by $1,000 to get 0.5%.

Formula for Calculating the Actual Amount of Claim!

In case of under-insurance, the Insurance Company applies the Average Clause. Under-insurance means insuring for lesser value of stock. This is because businessmen think that in case of fire outbreak the complete stock will not be burnt. So, they take insurance policy for partial stock, of course at a lesser premium.

In order to discourage under-insurance, generally the Average Clause is inserted by the Insurance Company. If the insured value of the stock is less than the total of stock, then the Average Clause may apply, that is, the loss will be limited to that proportion of the loss as the insured value bears to the total cost.

Formula for Calculating the Actual Amount of Claim:

ADVERTISEMENTS:

The actual amount of claim is determined by the formula:

Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum. For instance, if Rs 1,00,000 policy is taken for Rs 1,50,000 stocks, then the under-insurance will be by Rs 50,000.

Here, the insurer and insured will be the co-insurers for Rs 1, 00,000 and Rs 50,000 respectively. When, in such a case, Rs 30,000 stock is lost, then the Insurance Company indemnifies only Rs 20,000 i.e. 30,000 x 1,00,000/1,50,000 and the balance Rs 10,000 i.e. Rs 30,000 x 50,000/1,50,000 is met by the insured himself.

Thus, the under-insurance relieves the insurer and penalizes the insured for under-insurance. Irrespective of the insertion of such Clause, the entire policy amount insured, and then Insurance Company pays only the amount insured. When the loss is more than the sum insured, the insured can recover the whole amount in spite of Average Clause.

Illustration 1:

Malcom owns a retail stationery shop which was partly destroyed by fire on 27th June 2005. The stock was insured for Rs 13,000.

The Balance Sheet drawn on 31st December 2004 included, inter alia, the following items:

Actual Amount For Wartime Rationing

A physical check of stock after the fire showed that items undamaged were Rs 7,000. The normal rate of gross profit is 25% on purchases but the stock on 31st December 2004 included items of discontinued lines totaling Rs 3,800 which were all sold during next two months at cost.

ADVERTISEMENTS:

You are required to compute the amount of claim to be made to the insurer. There was an average clause in the policy.

Solution:

A purchase from 1.1.2005 to 27.6.2005 has not been given in this problem.

It is to be found out by preparing Sundry Creditors Account, as shown below:

Illustration 2:

From the following particulars in respect of Ram Prasad, ascertain the insurance claim with regard to the loss of stock due to a fire accident on 11th May 2005:

1. The Company had the practice of valuing stock at cost less 5%.

2. The value of fire insurance taken was for Rs 2, 15,000.

3. The policy was subject to average clause.

4. Stock as on 1.1.2004. Rs 2, 85,000.

5. Stock as on 31.12.2004, Rs 3, 80,000.

Actual Amount Of Playing Time For Nfl Game

6. Purchases made during the year. Rs 5, 20,000.

ADVERTISEMENTS:

7. Sales for the year 2004 Rs 6, 00,000.

8. Purchases from 1.1.2005 to the date of fire Rs 2, 19,000.

9. Sales from 1.1.2005 to the date of fire Rs 2, 70,000.

10. Value of stock salvaged Rs 30,000.

Related Articles: