© vitapix / Getty Images Woman in her 30s filling out tax information online.

© vitapix / Getty Images Woman in her 30s filling out tax information online.

No one likes filing income tax returns, but platforms such as H&R Block and TurboTax make the process more convenient and less intimidating. Both companies let you work online or download software to prepare returns to print and file by mail.

Get your taxes done right with TurboTax 2020 TurboTax is tailored to your unique situation—it will search for the deductions and credits you deserve, so you’re confident you’ll get your maximum refund. Get your taxes done right and your maximum refund Includes 5 free federal e-files and one download of a TurboTax state product. TurboTax Basic 2020. Shop all TurboTax. 4.5 out of 5 stars with 398 reviews. 398 398 ratings. 2 Questions 2 Questions questions. Delivery Method Download Code. Download Code A green circle with a white checkmark in the center. Physical Disc A green circle with a white checkmark in the center.

Popular Searches

Might Be a Lot: All the New Numbers You Need To Know for Planning Ahead on Taxes

Both services also give users access to tax professionals who — for an additional fee — can help you if you get stuck. And while H&R Block has always had tax pros available to complete your returns for you, TurboTax is providing that service for the first time. Both companies offer COVID-safe virtual tax preparation as well as drop-off service and in-person appointments.

So which online tax service is best? That depends on how complex your tax situation is and how much assistance you need.

This guide provides a breakdown of both tax-filing services to help you decide which one is best for you.

TurboTax vs. H&R Block

Is TurboTax better than H&R Block? For some users, perhaps. Here’s a look at what kind of user is best served by each platform.

TurboTax is best for users who:

- File simple federal and state returns by mail

- Don’t mind paying extra for the hand-holding TurboTax’s interview-style interface provides

- Want to e-file a state return using a downloaded version of the software

H&R Block is best for users who:

- Need to file one or more prior year returns

- Self-employed taxpayers looking for lower-cost support for reporting business expenses

- Have simple returns that include child/dependent care deductions, education-related deductions or unemployment income

Find Out: The Best Free Tax Software Programs To Use Right Now

TurboTax Overview

TurboTax’s simple interface helps users navigate the complex tax-filing process. You start by answering a series of questions designed to help TurboTax accurately assess your tax situation and transfer information to the correct forms, so you don’t have to enter it manually.

The free edition covers W-2 income plus the earned income tax credit and child tax credit. Upgraded editions cover additional, more complex situations such as education-related deductions, investment income and capital gains and losses. All editions import return users’ prior-year information.

The TurboTax CompleteCheck feature reviews your completed return to identify possible errors and oversights. You’re then ready to e-file your return or print it to file by mail. In either case, TurboTax walks you through the process.

Users who purchase the Live version of any online edition get on-demand help from a CPA or enrolled agent plus a line-by-line review of your return before you file it. Full Service customers turn over the whole process, from preparing to signing and filing their returns, to a professional. In addition to the online products, TurboTax offers a downloadable version and a mobile app you can use to complete and file your returns from your phone or tablet. You can also prepare prior-year returns from 2017-2019 to print and file by mail.

See: TaxAct vs. TurboTax — Which Is the Best Tax Software?

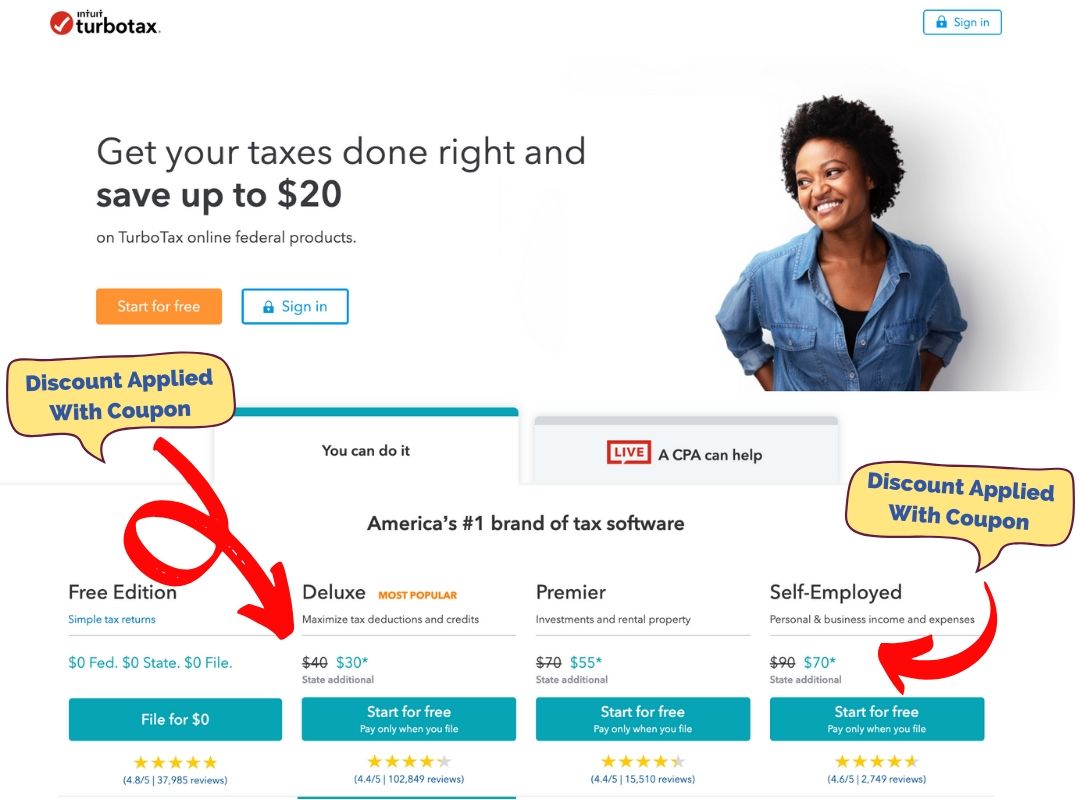

How Much Does It Cost To File Taxes With TurboTax?

How much you pay for TurboTax depends on the edition and format you use. You can do your taxes online or purchase a downloadable version, which is also available on CD. Live and Live Full Service are extra, and Live is available with online editions only. Here’s an overview of the different TurboTax editions and options, with their cost:

| TurboTax Filing Options At a Glance | ||

| Tax Software | Cost | Best For |

| Free (Basic) |

| Simple tax returns |

| Deluxe |

| Itemizing deductions and credits |

| Premier |

| Investors and rental property owners |

| Self-Employed |

| Entrepreneurs and business owners |

| Basic (Download) |

| Simple tax returns |

| Deluxe (Download) |

| Maximizing your deductions |

| Premier (Download) |

| Investors and rental property owners |

| Home & Business (Download) |

| Entrepreneurs and business owners |

| Information accurate as of Jan. 13, 2021. |

Although most of the downloadable software options cost more than filing online, each purchase includes five federal e-files.

Do It Right: Most Popular Things To Do With Your Tax Refund — and How To Do It Smarter

H&R Block Overview

H&R Block is similar to TurboTax in terms of features and the availability of live assistance from a tax professional. The software walks you through entering information about your income, deductions and credits and special situations and reviews your return before you file it.

But H&R Block’s free version of the software includes more forms than TurboTax’s equivalent edition. In addition, H&R Block’s pricing for filing state income tax is more straightforward compared to TurboTax.

Like TurboTax, H&R Block has an extensive library of tax tips and information you can use all year long. H&R Block also offers professional tax preparation services for those who decide mid-return that their tax filing is best left to an expert.

How Much Does It Cost To File Taxes With H&R Block?

H&R Block has both online and downloadable software options to guide you through the tax filing process. Here’s an overview of the different products H&R Block offers, including fees:

| H&R Block Tax Filing Options At a Glance | ||

| Tax Software | Cost | Best For |

| Free Online Tax Filing |

| New filers or simple tax returns |

| Deluxe Online Tax Filing |

| Homeowners and maximizing deductions |

| Premium Online Tax Filing |

| Self-employed, investors and rental property owners |

| Self-Employed Online Tax Filing |

| Self-employed and small-business owners |

| Basic (Download) | $19.95 federal, $39.95 per state, $19.95 per state e-file | Simple tax returns |

| Deluxe + State (Download) | $49.95 federal and state, $19.95 per state e-file | Homeowners and investors |

| Premium (Download) | $69.95 federal and state, $19.95 per state e-file | Self-employed and rental property owners |

| Premium and Business (Download) | $89.95 federal and state, $19.95 per state e-file | Small-business owners |

| Information accurate as of Jan. 13, 2021. |

H&R Block’s downloaded versions include five free federal e-filings.

Prices start at $69 to have a tax pro prepare your taxes for you, but you’ll need to schedule a call, chat or appointment to get the exact cost.

Learn About: Free State Tax Filing Options

TurboTax vs. H&R Block: Ease of Use

Both platforms are easy to use. For example, both let you upload a PDF of last year’s return so that you can import the information even if you used a different platform. And both prompt you for information needed to complete your forms to eliminate any guesswork on your part.

You can also upload W2s automatically in many cases. Or if the forms aren’t available for import, scan them in by taking a picture with your phone.

TurboTax has a slight edge on H&R Block in that you can pull up a list of documents you need to do your return and view a topic list that shows exactly where you are in the process. And unlike H&R Block, which forces you to work through the sections in order — first income, then deductions and credits — TurboTax lets you move freely between sections. Skipping around comes in handy when, for example, you want to start working on deductions because you’ve not yet received all your income statements.

See: TaxHawk Review — Find Out If This Tax Software Flies Above Its Peers

TurboTax vs. H&R Block: Customer Service

The TurboTax website has an extensive knowledge base and an online community where users and TurboTax employees answer questions, but you’ll have to jump through hoops to talk with a live customer service representative.

From H&R Block’s support page, you can contact an office, get help with your account or request technical support for your tax preparation product. You can also find answers to tax questions and access resources like a tax preparation checklist.

Read Next: What Happens When You File Your Taxes Late?

TurboTax vs. H&R Block: Coronavirus Resources

As a result of the COVID-19 pandemic, many taxpayers received income like stimulus checks, unemployment compensation and self-employment assistance they’re not sure how to handle on their tax returns. And employees who were forced to work remotely might be eligible for tax deductions they’re unfamiliar with. TurboTax and H&R Block both have COVID-19 sections on their websites to help taxpayers understand how these extraordinary circumstances affect their taxes.

You’ll also find information about the stimulus payments themselves. Both companies offer calculators to help you estimate how much you’ll receive as well as instructions on how to check on your payments and what to do if you haven’t received one or both.

See: Didn’t Get Your Stimulus Check? You Might Want to Blame TurboTax or H&R Block

Which Online Tax Service Is Best?

The best tax service for you depends on what you’re looking for. Filers who want a full range of filing options and easy access to customer service are likely to find that H&R Block is better suited to their needs. H&B Block’s strength in both areas, plus its generally lower cost, makes it well worth considering.

H&R Block is also the better choice for anyone with prior-year returns to file. Whereas TurboTax has 2017-2019 prior-year products available, H&R Block goes back to 2016 and has updates for editions from as early as 2012

TurboTax charges a premium price, but users might find its topic directory and flexibility appealing. Although contacting a live support agent can be frustrating, community forums and an extensive knowledge base might suffice for many users.

TurboTax and H&R Block both provide robust, easy-to-use platforms with free and paid options. And just as important, both companies back their products with accuracy and maximum refund guarantees.

More From GOBankingRates

Taylor Bell contributed to the reporting for this article.

This content is not provided by the companies mentioned. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone and have not been reviewed, approved or otherwise endorsed by H&R Block or TurboTax.

Last updated: Jan. 14, 2021

Turbotax

This article originally appeared on GOBankingRates.com: H&R Block vs. TurboTax: Which Is Best for Your 2020 Tax Return?